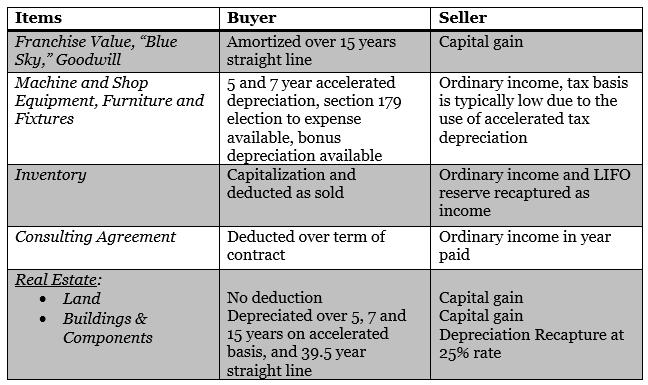

Dealers deciding to take advantage of the active merger and acquisition market should first be aware of the income tax effect of a purchase or sale. In this article, the tax treatment of items in a buy/sell will be explained to highlight the tax implications that can impact buyers and sellers. The chart below reflects the conflicting tax implications to the buyer and seller.

The breakdown of each category should be outlined in the Letter of Intent and the Purchase and Sale Agreement to avoid unnecessary time delays and negotiations. We have seen unnecessary holdups, and, in some cases, deals terminated when the asset allocations were not determined at the outset of the transaction.

Note that both the buyer and seller must file IRS Form 8594 in the year of the sale and identify asset categories as designated in the Purchase and Sale Agreement. The asset categories must be identical for each party. Best practice suggests that the form 8594 be created at the closing.

It is important for the buyer to obtain a cost segregation study when purchasing dealership real estate, with the goal of allocating assets to shorter depreciable lives.

If you have any questions regarding this article, please contact Paul McGovern at PMcGovern@DowneyCoCPA.com or at 800-849-6022.